KS ST-8 2007-2025 free printable template

Show details

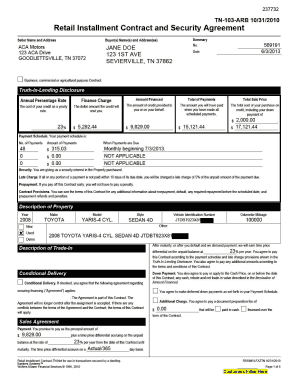

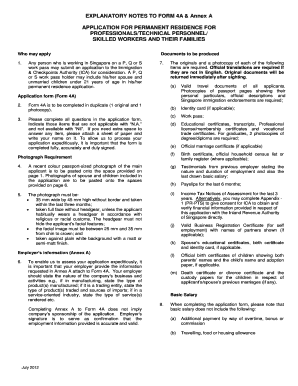

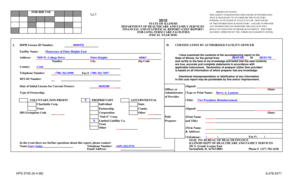

O. Box 2369 Topeka Kansas 66601-2369. Please send a new pad of Form ST-8. Dealer No. Street KS Zip Code To order more ST-8 booklets please fax your order to Dealer Licensing 785-296-5854 Carbonless type paper. KANSAS DEPARTMENT OF REVENUE--Division of Taxation STATEMENT OF KANSAS STATE AND LOCAL RETAIL SALES TAX PAID This is to certify that the day of of Kansas did on pay Sales Tax indicated to the under- signed on the motor vehicle described hereon. Dealer s License No. Sales Tax Account...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign st 8 form

Edit your kansas sales tax receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form st 8 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st 8 form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit kansas sales tax form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st 8 tax form

How to fill out KS ST-8

01

Obtain the KS ST-8 form from the Kansas Department of Revenue website or a local office.

02

Provide your name and contact information at the top of the form.

03

Indicate the type of exemption you are applying for by checking the appropriate box.

04

Fill out the required details about your business or organization, including its address and tax identification number.

05

Provide a detailed explanation of why you qualify for the exemption.

06

Attach any necessary supporting documentation that verifies your claim for exemption.

07

Review the form for accuracy and completeness before submission.

08

Submit the form to the Kansas Department of Revenue via mail or in person, as directed.

Who needs KS ST-8?

01

Businesses and organizations in Kansas seeking tax-exempt status.

02

Nonprofit organizations that meet the criteria for exemption under Kansas tax laws.

03

Individuals or entities looking to claim a sales tax exemption on specific purchases.

Fill

who is required to file search

: Try Risk Free

People Also Ask about form st8

What is a K 40V?

K-40V Individual Income Tax Payment Voucher Rev.

What are the filing requirements for Kansas?

Kansas Form K-40 Instructions A Kansas resident must file if he or she is:And gross income is at least:MARRIED FILING JOINT65 or older and blind (both spouses)$14,800HEAD OF HOUSEHOLDUnder 65$10,00065 or older or blind$10,85065 or older and blind$11,70011 more rows

What is K 19 form?

Kansas Form K 19 is an income tax form for those with Kansas taxable income. This is a widely used form throughout the state.

What is a K-40 form?

If you need to change or amend an accepted Kansas State Income Tax Return for the current or previous Tax Year you need to complete Form K-40. Form K-40 is a Form used for the Tax Return and Tax Amendment.

What is a form K 40C in Kansas?

Kansas uses Form K-40C to file a composite return on behalf of non-resident shareholders. Open the federal tab Shareholders > Shareholder Information. Enter the code for the shareholder's resident state in the column titled State or Resident State Code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my kansas emancipation forms directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your register for sales tax in kansas and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify kansas sales tax certificate without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like kansas sales tax exemption form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit cr 108 kansas form straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit kansas tax exempt form pdf.

What is KS ST-8?

KS ST-8 is a form used in the state of Kansas for reporting sales and use tax.

Who is required to file KS ST-8?

Businesses that have taxable sales or purchases in Kansas and are registered to collect sales tax are required to file KS ST-8.

How to fill out KS ST-8?

To fill out KS ST-8, gather sales information, list all taxable and exempt sales, calculate total tax due, and provide necessary business identification details before submitting the form.

What is the purpose of KS ST-8?

The purpose of KS ST-8 is to report and remit the sales and use tax collected by businesses to the state of Kansas.

What information must be reported on KS ST-8?

Information that must be reported on KS ST-8 includes total sales, taxable sales, exempt sales, tax collected, and business identification information.

Fill out your KS ST-8 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

K 9 Tax Form is not the form you're looking for?Search for another form here.

Keywords relevant to kansas resale certificate

Related to 8 sales tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.